Ethereum staking has always presented a challenge for institutions: how do you earn yield and participate in securing the network without locking capital or sacrificing liquidity and composability? For years, direct staking meant giving up liquidity, while liquid staking meant losing control over validator choice, economics, and compliance requirements.

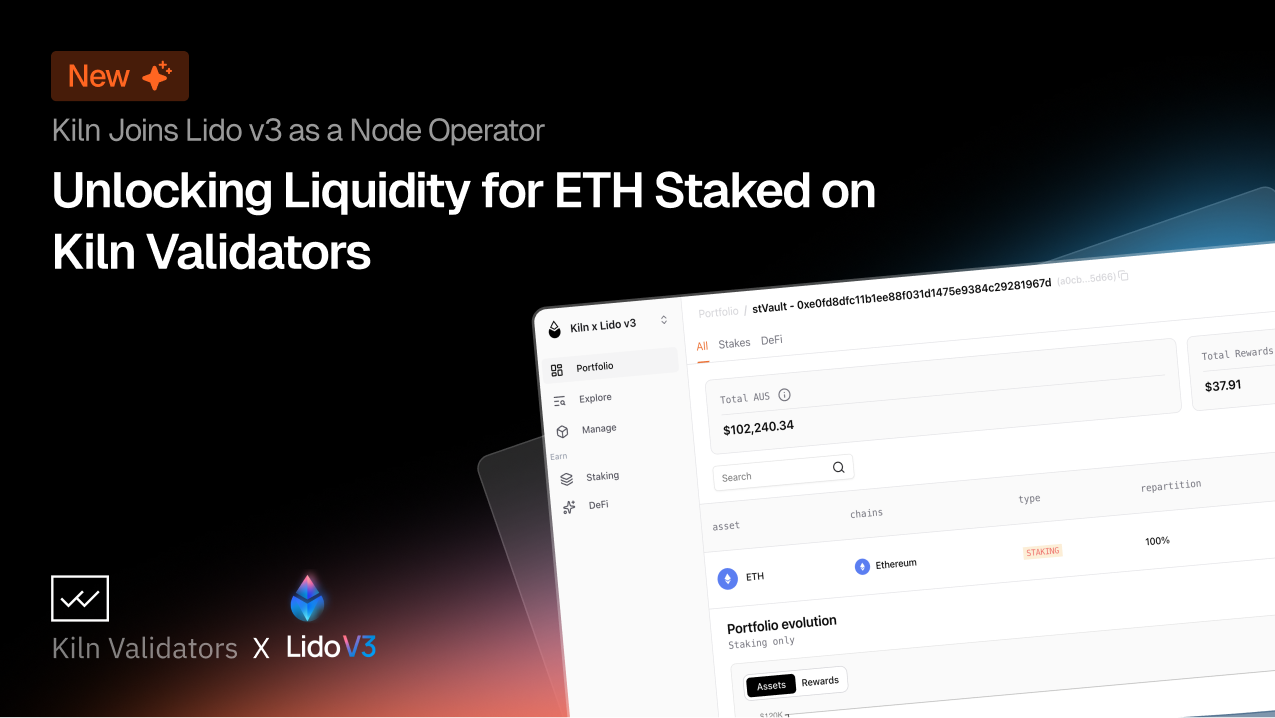

With the launch of Lido v3 and Kiln's inclusion as an early node operator within the stVault ecosystem, this challenge is finally addressed. The new model brings together institutional control, liquidity, and capital efficiency in a single solution.

Bridging two worlds: control + liquidity

Traditional staking models for institutions have largely been a choice between:

- Direct validator staking, where institutions maintain strict operational control, custom rev-share agreements and compliance but give up liquidity until exit;

- Pooled liquid staking (e.g., traditional stETH), which delivers deep liquidity and DeFi composability but at the cost of validator choice, pooled economics, and commingled asset exposure.

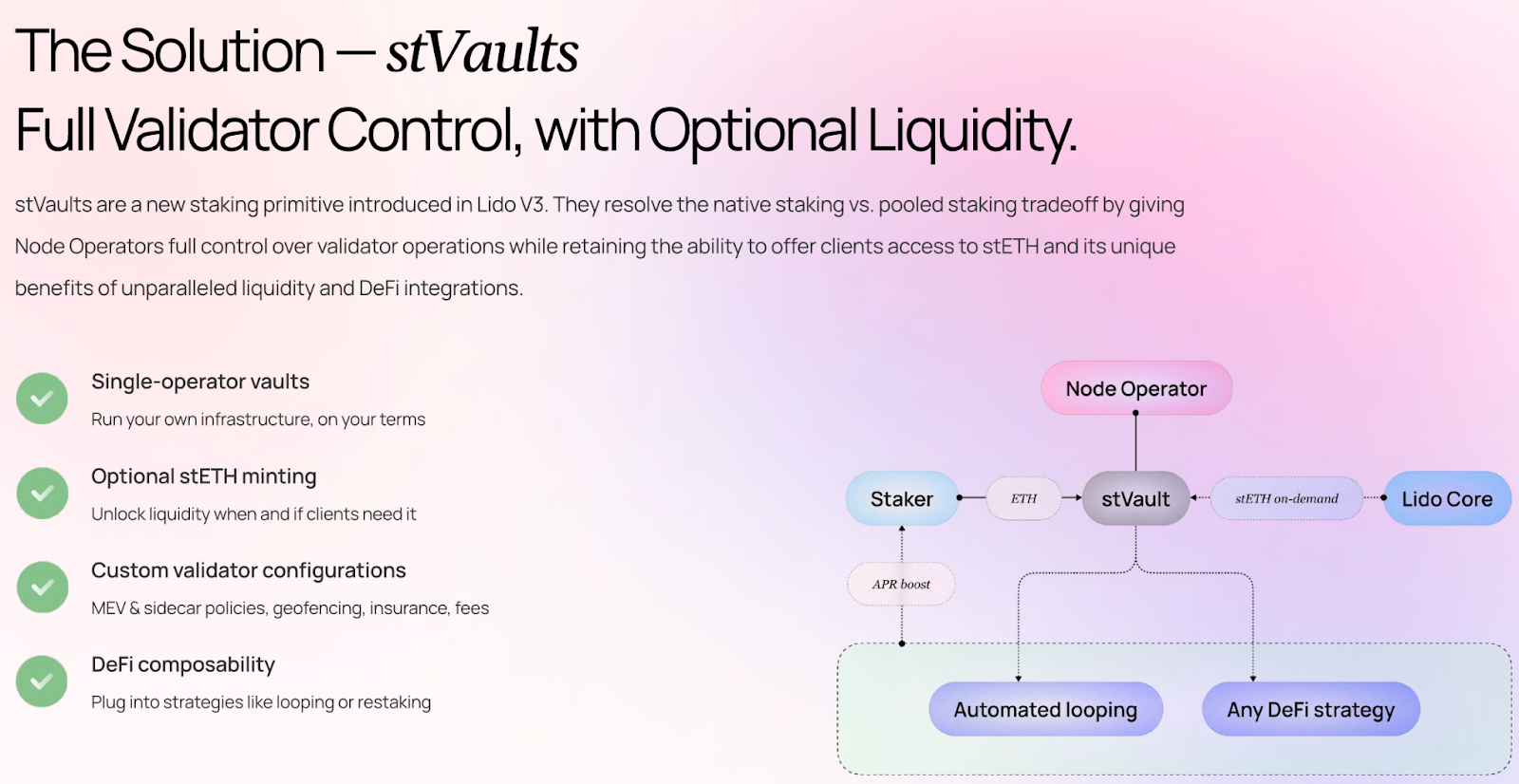

Lido v3 introduces stVaults, a new smart contract primitive that allow institutions to customize staking setups while retaining access to stETH liquidity. These vaults combine the liquidity and DeFi footprint of stETH with isolated, auditable, institution-grade ETH validators.

Kiln x Lido v3 stVaults

As a Lido v3 node operator, Kiln now operates validators for specific stVaults. This means:

- ETH is staked on Kiln’s trusted validator infrastructure

- Customers can mint stETH backed by ETH staked with Kiln

- Validator control, performance monitoring, and operational execution remain with Kiln

- Assets are isolated at the vault level (no commingling) and transparently attributable

In practice, this lets customers unlock liquidity without altering their validator’s performances with Kiln.

Understanding stVaults

stVaults aren't DeFi yield vaults – they're Lido v3's technical infrastructure that lets you mint stETH against ETH staked with specific node operators like Kiln.

Your ETH stays on Kiln validators. The stVault simply enables stETH minting. What you do with that stETH afterward (DeFi, trading, etc.) is your choice.

Note: You can, however, use your stETH to deposit into Lido Earn vaults.

Use cases

1. Regain liquidity without exiting validators

ETH staked with Kiln no longer needs to sit illiquid until the network exit queue clears. With stVaults, institutions can mint stETH against their staked position, gaining access to liquidity without interrupting validator operations.

- This enables ETH staking products to fulfill withdrawal requests more efficiently. Instead of unstaking validators and redeploying them the next day, liquidity remains available, improving performance and user experience. This also means you can stake a larger amount of ETH, rather than keeping capital idle to meet withdrawal demands.

2. Higher performance on existing stETH stake

Current stETH holders can redirect their stake to Kiln validators within Lido v3 stVaults. With Kiln's 12% better performance vs. Lido pool average, you earn higher yields while maintaining full stETH liquidity and composability.

3. Use stETH across DeFi & CeFi

Once minted, stETH integrates seamlessly with Ethereum’s broader ecosystem:

- Lending protocols like Aave, Compound and Morpho

- Use stETH on exchanges for trading and hedging strategies

- Restaking environments such as EigenLayer, Symbiotic or similar protocols

This composability unlocks capital efficiency for institutional strategies, allowing staked positions to participate in broader yield generation.

💡 Coming in Q2 2026: Kiln will enable Multiplied ETH Staking, a strategy built by leading asset-management partners. Deposit ETH, which is minted into stETH and used to increase effective exposure to ETH staking rewards, without relying on external yield sources. Available through Kiln OmniVault for integrators and directly in the Kiln Dashboard.

Economic breakdown

When using a Lido v3 stVault operated by Kiln, two Lido-level fees apply in addition to the node operator fee agreed with Kiln:

1. Lido Infrastructure Fee (1%)

Lido charges a 1% infrastructure fee on staking rewards generated by the vault.

This fee is calculated on the Lido Core APR, not on the total staked balance.

Example:

If you stake 10,000 ETH and the Lido Core APR is 2.76%, total rewards are:

- 10,000 × 2.76% = 276 ETH

- Lido infrastructure fee: 1% of 276 ETH = 2.76 ETH

This fee supports Lido’s protocol infrastructure and governance.

2. Liquidity Fee (6.5%, only when stETH is minted)

If and only if you mint stETH from your stVault, a 6.5% liquidity fee applies.

This fee is:

- Charged only on the rewards corresponding to the amount of stETH minted

- Calculated on the Lido Core APR

- Applied only for the duration stETH is minted

Example:

If you mint 9,000 stETH for one year and the Lido Core APR is 2.76%, the fee is:

- Rewards from stETH minted: 9,000 × 2.76% = 248.4 ETH

- Lido liquidity fee: 6.5**% of 248.4 ETH = 16.2 ETH**

If no stETH is minted, this fee does not apply.

Comparing Staking Options

APR & Fee Structure

| Kiln Direct | Lido Core | Lido v3 stVaults via Kiln | |

|---|---|---|---|

| Total Staked | 10,000 ETH | 10,000 ETH | 10,000 ETH |

| Node Operator Fee | TBD per partner | N/A | TBD per partner |

| Lido DAO Infra Fee | N/A | 5%* | 1% |

| Lido DAO Liquidity Fee | N/A | N/A | 6.5% (on minted stETH) |

| Kiln Staking APR | 2.83% | N/A | 2.83% |

| Lido Core APR | N/A | 2.76% | 2.76% |

*(+5% for node operators)

Reward Outcomes (Illustrative)

| Kiln Direct | Lido Core | Lido v3 stVaults via Kiln | |

|---|---|---|---|

| Gross Rewards | 283 ETH | 276 ETH | 283 ETH |

| Node Operator Fee | TBD per partner | N/A | TBD per partner |

| Lido Infra Fee | N/A | 27.6 ETH | 2.76 ETH |

| Lido Liquidity Fee | N/A | N/A | 0 to 16.2 ETH* |

| Net Rewards to Staker | 283 ETH | 248.4 ETH | 280.3 to 264 ETH* |

| Net APY | Up to 2.83% | 2.48% | ~2.64% to 2.80%* |

*The range in stVault outcomes depends on how much stETH is minted and for how long.

Over the past 12 months, Kiln’s validators have consistently outperformed the Lido pool average under comparable network conditions.

Even after accounting for Lido’s infrastructure and liquidity fees, this means that:

- Staking with Kiln via stVaults and minting stETH can be up to 12% more profitable than minting stETH directly from the public Lido pool, while maintaining full access to stETH liquidity.

Kiln has built a custom calculator to help customers compare, reach out to get access and evaluate what works best for your staking strategy.

Who should be looking at stVaults?

This integrated model is particularly relevant for:

- Exchanges and platforms looking to improve their staking offering performance and withdrawal liquidity without relinquishing control

- Custodial services integrating staking for smoother entry and exit capabilities

- Asset managers seeking to blend staking yield with capital efficiency

- Funds and market makers optimizing balance sheet liquidity

Participation in stVault-backed staking is optional, direct staking with Kiln remains fully supported. What’s new is the ability to add liquidity and composability without compromising control.

Early access to Multiplied ETH Staking

While stVaults unlock liquidity for your Kiln validators, we're taking it further.

Launching in Q2 2026:

Kiln will enable Multiplied ETH Staking strategy, built on Lido v3 and managed by selected asset-management partners.Instead of staking and managing complex staking mechanics yourself, simply deposit ETH and benefit from increased exposure to ETH staking rewards automatically.Available through Kiln OmniVault and the Kiln Dashboard.

Ready to unlock liquidity for your staked ETH while maintaining control over your validators? Contact our team to explore how Kiln's Lido v3 stVault integration can optimize your staking strategy.

About Kiln

Kiln is the leading staking and digital asset rewards management platform, enabling institutional customers to earn rewards on their digital assets, or to whitelabel earning functionality into their products. Kiln runs validators on all major PoS blockchains, with over $11 billion in crypto assets being programmatically staked and running over 5% of the Ethereum network on a multi-client, multi-cloud, and multi-region infrastructure. Kiln also provides a validator-agnostic suite of products for fully automated deployment of validators and reporting and commission management, enabling custodians, wallets, and exchanges to streamline staking or DeFi operations across providers. Kiln is SOC2 Type 2 certified.