Removing barriers to staking Toncoin

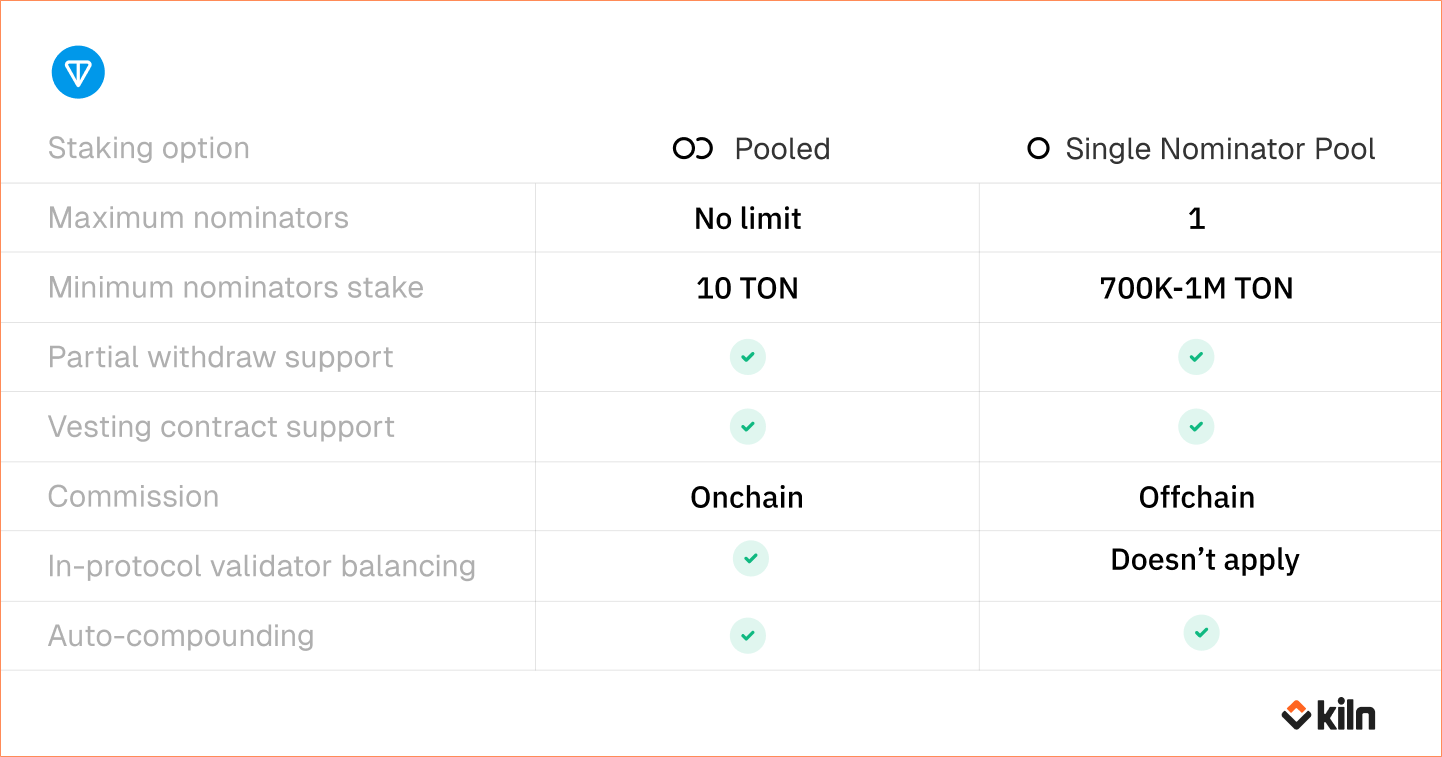

Running a traditional single nominator pool on TON has typically meant committing at least ~700k–1M TON. Even large holders capable of hitting the minimum still face operational drag: they must spin up multiple SNP pools to avoid delegation caps, then manually move liquidity between them to keep yields optimal.

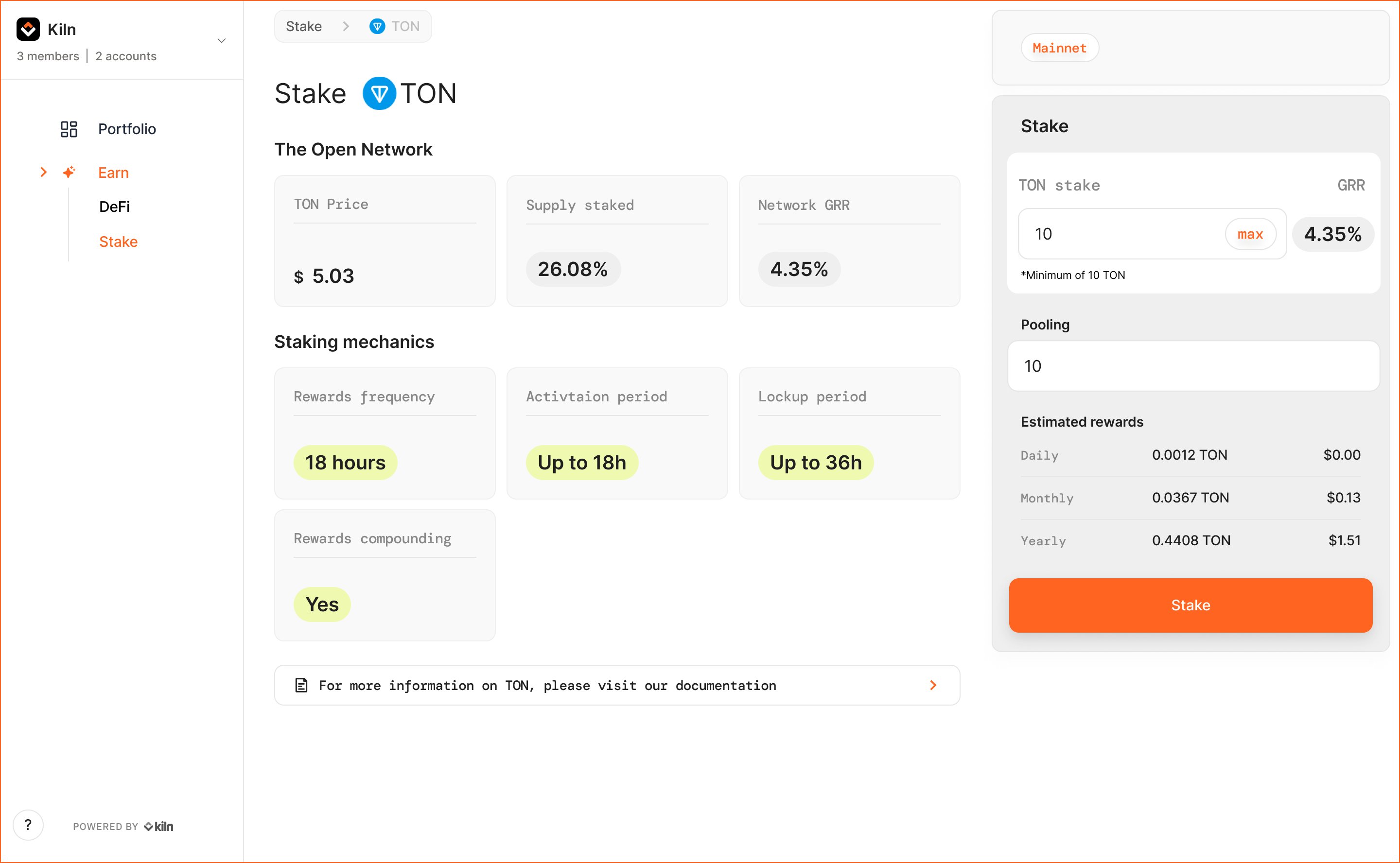

Kiln TON Pooled Staking lets partners stake from 10 TON, so any user or institution can help secure the TON network and earn rewards – without standing up a large validator position.

How it works

Kiln integrates with the TonWhales pool contract architecture and layers in Kiln’s institutional controls: account segregation, allow-lists, audit exports, and compliance checks (KYC/AML checks, geoblocking).

- Kiln Dashboard – 1-click TON staking from your custodian or treasury account. Built-in segregation, allow-lists, reporting.

- Kiln Connect API – embed TON staking in wallet & exchange products. Pull per-account balances, reward accruals, fee splits, and historical distributions via API or CSV exports.

Rewards and withdrawals

Pooled TON staking rewards have historically tracked single nominator returns in the ~4–5% range:

Staking $50M in TON at 4% APY would generate roughly $2M in gross annual rewards before fees and compounding.

Full historical reward data and exports are available in the Kiln Dashboard and via the Reporting API.

Unstaking follows TON network parameters. Exits typically finalize within ~1 epoch (currently ~18h). Both partial and full withdrawals are supported.

TON staking with built-in institutional-grade safeguards

Kiln operates two pool classes so partners can match their compliance posture without code changes:

Enterprise: only whitelisted wallets can deposit. Dashboard and tx‑crafting API users are auto‑approved. Ideal for custodians, treasuries, asset managers.

Retail: any user may deposit through supporting wallets or exchanges. Ideal for broad distribution and embedded retail flows.

Bringing enterprise-grade to everyone:

- Audited smart contracts – Kiln infrastructure undergoes ongoing independent security audits.

- Segregated fee accounting – operational fees cleanly separated from staking principal & rewards for transparent reconciliation.

- SOC 2 Type II certified platform – multi-client, multi-cloud, multi-region infrastructure operated to institutional standards.

Prefer to run your own TON validator?

We continue to support Dedicated (Single Nominator) Pools with minimums in the ~700k–1M TON range (capital requirements vary with network dynamics). Choose this route if you want full stake segregation, policy control, custom commission, or branded validator visibility.

Across Kiln-operated TON validators, we currently secure ~$300M in TON stake (~12% network share).

Integrate your way

TON staking is available today in the Kiln Dashboard for existing clients. You can also leverage Kiln Connect – a seamless SDK that lets you craft, sign, and broadcast TON transactions through a single interface, with a comprehensive reporting API.

Ready to explore? Contact us and we’ll get you started.

About Kiln

Kiln is the leading staking and digital asset rewards platform for institutions. We run validators across major Proof‑of‑Stake blockchains and power embedded staking in custodians, wallets, and exchanges worldwide. Over $14B in digital assets are programmatically staked through Kiln, including more than 12% of TON’s network and 6% of the Ethereum network across a multi‑client, multi‑cloud, multi‑region stack. Kiln is SOC 2 Type II certified and provides tooling for automated validator deployment, reporting, and commission management across providers.

About Kiln

Kiln is the leading staking and digital asset rewards management platform, enabling institutional customers to earn rewards on their digital assets, or to whitelabel earning functionality into their products. Kiln runs validators on all major PoS blockchains, with over $11 billion in crypto assets being programmatically staked and running over 5% of the Ethereum network on a multi-client, multi-cloud, and multi-region infrastructure. Kiln also provides a validator-agnostic suite of products for fully automated deployment of validators and reporting and commission management, enabling custodians, wallets, and exchanges to streamline staking or DeFi operations across providers. Kiln is SOC2 Type 2 certified.